Opening branch office in Qatar allows a foreign company to carry out a specific project or service contract in the country. It operates under the name of the parent company and does not create a separate legal entity.

This structure is commonly used by foreign engineering, contracting, and consultancy firms that have signed a government or public-sector contract. The parent company can own the branch fully and manage its operations in Qatar.

At Meem Business Services, we assist international companies through every step of the company opening and registration process.

Our team prepares the required documentation, handles attestations, submits applications to the authorities, and completes registration within approved timelines.

This guide explains who is eligible to open a branch office in Qatar, what documents are required, the step-by-step registration process, and the average time needed for completion.

TL;DR — Opening a Branch Office in Qatar

Here is a quick summary of the process, timeline, and main requirements for foreign companies planning to open a branch office in Qatar.

| Structure | Extension of the foreign parent company |

|---|---|

| Ownership | 100% foreign ownership allowed for approved government or public projects |

| Trading Rights | Can execute the approved contract, hire staff, and open a bank account |

| Tax | 10% corporate tax on Qatar-based profits |

| Capital | No minimum share capital requirement |

| Average Timeline | Usually between 8 and 12 weeks depending on approvals |

| Approximate Initial Fees | Commonly between QAR 8,000 and 12,000, based on document and activity type |

| Best For | Foreign firms with a government or semi-government contract |

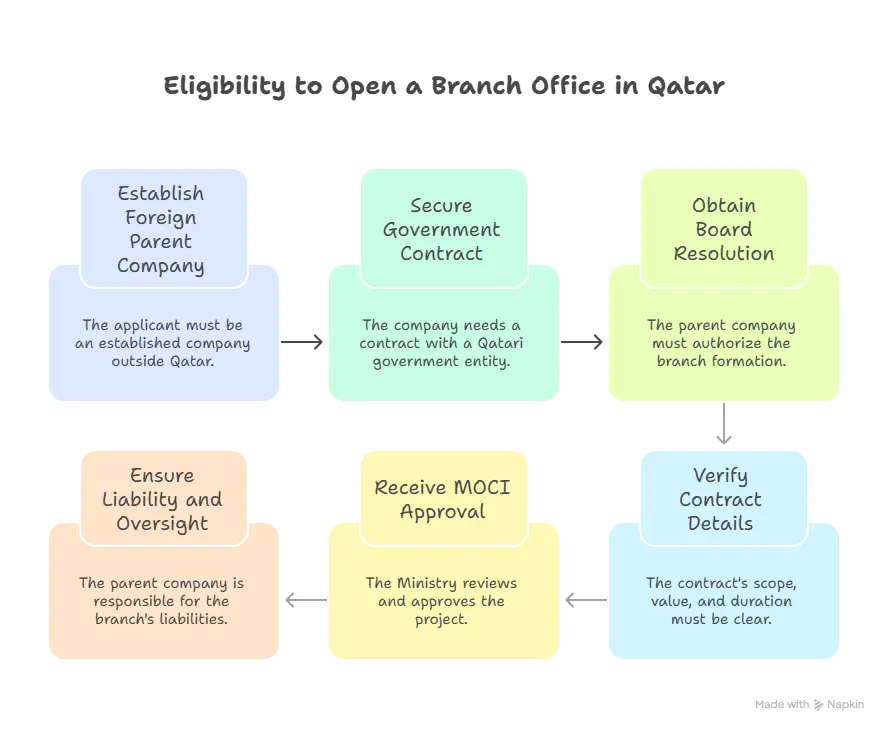

Eligibility to Open a Branch Office in Qatar

To register a branch office in Qatar, a foreign company must meet specific regulatory and project-based conditions set by the Ministry of Commerce and Industry (MOCI).

1. Foreign Parent Company

The applicant must be an established company outside Qatar with valid incorporation documents and a proven business record. The branch functions as an extension of this parent company.

2. Government or Public-Service Contract

A branch license is issued only when the foreign company has a contract that serves a government or public-interest project. The contract or award letter must come from a Qatari ministry, authority, or semi-government body.

This condition follows Law No. 1 of 2019 on the Investment of Non-Qatari Capital and the related MOCI guidelines.

3. Written Authorization

The parent company must issue a board resolution authorizing the branch formation in Qatar and appointing a local manager with signing authority.

4. Contract Verification

The contract must clearly define the project scope, value, and duration, confirming that the branch will execute specific work or services inside Qatar.

5. MOCI Approval

The Ministry reviews the company documents and the government contract to confirm that the project qualifies as a public-interest activity. Approval is mandatory before commercial registration.

6. Liability and Oversight

The parent company is legally responsible for all liabilities of the branch, including taxes, staff obligations, and regulatory compliance.

You can refer out article on branch office vs representative office setup in Qatar, if you are unsure about them and it will help you choose one.

At Meem Business Services, we assess your project eligibility before filing the application, ensuring that your contract and documentation meet MOCI’s requirements from the start.

Our PRO consultants verify every document, coordinate with the reviewing departments, and help secure branch approval without delays.

Documents for Branch Office Registration in Qatar

All documents must be correctly prepared, attested, and translated before submission to the Ministry of Commerce and Industry (MOCI). Missing or incorrectly attested papers are the main cause of application delays.

1. Application Form

Completed branch-registration form available through the Single Window Investor Portal.

2. Certificate of Incorporation

Official registration certificate of the parent company, attested by the Qatari Embassy and the Ministry of Foreign Affairs.

3. Memorandum and Articles of Association

A certified copy that outlines the company’s legal structure and authorized activities.

4. Board Resolution

Resolution authorizing the creation of the branch in Qatar and appointing a General Manager with signing authority.

5. Power of Attorney

Legal authorization for the local signatory to act on behalf of the parent company.

6. Government or Public-Service Contract

A copy of the contract or award letter confirming that the project serves a government or public entity.

It must include project value, duration, and scope of work.

7. Passport Copies

Valid identification for the appointed General Manager and the authorized signatories.

8. Company Profile and Activities List

Summary of the parent company’s background, areas of specialization, and relevant experience.

9. Arabic Translations

All foreign-language documents must be translated into Arabic by a certified translator in Qatar.

10. Legalization and Notarization

All corporate and legal documents must be legalized in the company’s home country, notarized, and then re-attested by the Qatari Embassy before submission to MOCI.

Step-by-Step Registration Process

The process of opening a branch office in Qatar involves several government stages. Each step must be completed in order to receive full commercial registration and operating rights.

Step 1 – Verify Contract Eligibility

Confirm that your contract qualifies under Law No. 1 of 2019 as a public-interest or government project.

The contract must be issued by a Qatari ministry, authority, or semi-government entity.

Meem reviews your agreement before submission to confirm it meets MOCI’s criteria.

Step 2 – Prepare and Attest Documents

Collect all corporate documents from the parent company, including the Certificate of Incorporation, Memorandum of Association, Power of Attorney, and Board Resolution.

Translate and attest all papers through the Qatari Embassy and the Ministry of Foreign Affairs.

Step 3 – Submit Application to MOCI

File the branch registration request through the Single Window Investor Portal.

Attach the attested documents and contract copy. Once accepted, MOCI issues an initial approval allowing you to proceed with commercial registration.

Step 4 – Obtain Commercial Registration (CR)

After MOCI approval, the branch is listed under the parent company name. You will receive a Commercial Registration certificate with a company number that legally identifies the branch in Qatar.

Step 5 – Apply for Trade License

Lease an office space for at least one year. Apply for a Trade License through the local Municipality office.

An inspection may be carried out to verify the location.

Step 6 – Get Establishment Card (Immigration Department)

Register the branch with the Ministry of Interior to obtain an Establishment Card. This card authorizes the branch to hire employees and issue residence permits.

Step 7 – Register for Tax and Appoint an Auditor

Apply for a Tax Identification Number (TIN) with the General Tax Authority. Appoint a Qatar-licensed auditor within 30 days of receiving the CR. Branches are subject to 10 percent corporate tax on Qatar-based profits.

Step 8 – Register with Qatar Chamber

Membership with the Qatar Chamber of Commerce and Industry is required for all registered businesses.

Submit a copy of the CR, Trade License, and establishment documents.

Step 9 – Open Corporate Bank Account

Use the branch’s CR, Trade License, and Power of Attorney to open a corporate bank account with a local or international bank in Qatar.

Step 10 – Final Review and Renewal

Once all registrations are complete, MOCI issues the final branch registration certificate. Both the Trade License and Commercial Registration must be renewed annually.

If you want to know about representative office opening and registration process you can refer this article

At Meem Business Services, our legal and PRO teams handle every step on behalf of your company. We coordinate directly with the government portals, schedule inspections, and monitor approvals to keep your project on track and fully compliant.

Timeline and Fees

The time required for opening a branch office in Qatar depends on document readiness, contract verification, and government processing speed.

On average, full registration takes eight to twelve weeks from document submission to final license issuance.

Estimated Processing Timeline

| Stage | Activity | Average Duration |

|---|---|---|

| 1 | Contract review and eligibility confirmation | 1 – 2 weeks |

| 2 | Document attestation and Arabic translation | 1 – 2 weeks |

| 3 | MOCI application and initial approval | 2 – 4 weeks |

| 4 | Commercial Registration (CR) issuance | 1 week |

| 5 | Trade License and Municipality inspection | 1 week |

| 6 | Establishment Card and Immigration setup | 1 week |

| 7 | Tax registration and auditor appointment | 1 week |

| Total | Average completion period | 8 – 12 weeks |

Estimated Fees

| Item | Typical Cost (QAR) | Notes |

|---|---|---|

| Commercial Registration (CR) | 1,500 – 2,500 | Government fees vary by activity |

| Trade License | 3,000 – 4,000 | Municipality-dependent |

| Qatar Chamber membership | 1,200 – 1,500 | Annual fee |

| Establishment Card | 200 | Ministry of Interior charge |

| Translation and attestation package | 1,500 – 3,000 | Based on document count |

| Auditor registration | 500 – 1,000 | Paid to licensed auditor |

| Approximate Total Initial Cost | 8,000 – 12,000 QAR | Excludes rent and bank charges |

Actual costs may differ depending on project scope and document origin.

At Meem Business Services, we prepare a detailed cost summary before starting the process and align it with the latest government fee schedule.

You can speak directly with our setup team or use the Branch Office Cost Calculator on our website to estimate your total investment and processing time.

Advantages of a Branch Office in Qatar

Opening a branch office in Qatar provides several operational and financial advantages for foreign companies executing projects in the country.

1. 100 Percent Foreign Ownership

A branch allows the parent company to operate in Qatar without a local partner when approved under Law No. 1 of 2019 on the Investment of Non-Qatari Capital. This gives full control over management, finances, and service delivery.

You can refer our article on 100 business ownership to know more about it.

2. Direct Contract Execution

The branch can sign contracts, raise invoices, and receive payments directly from clients in Qatar.

This enables faster project execution and eliminates the need for intermediaries.

3. No Share Capital Requirement

Unlike an LLC, a branch does not require a minimum share capital deposit. The financial strength of the parent company supports its local operations.

We have prepared a dedicated article on LLC company formation in Qatar and you can refer it if you want to know more about it.

4. Simple Ownership Structure

The branch operates under the same legal identity as the parent company, avoiding complex shareholder arrangements or capital distribution rules.

5. Access to Local Facilities and Banking

Once registered, the branch can open a corporate bank account, lease office space, and apply for work visas under its own Establishment Card.

6. Strong Market Presence

A registered branch builds visibility and credibility in Qatar’s business market, helping foreign firms establish long-term relationships with government entities and major contractors.

You can use our Qatar market research and analyzer to know about Qatar and its business market.

Limitations of a Branch Office in Qatar

While a branch office gives full foreign ownership and direct project access, it also comes with specific limitations that companies should consider before applying.

1. Restricted Eligibility

Only foreign companies that have a government or public-interest contract can open a branch.

Private commercial activities are not permitted under this structure without special approval from the Ministry of Commerce and Industry (MOCI).

2. Temporary License Validity

The branch license is linked to the duration of the approved project.

If the project ends, the license must be renewed or closed unless the company secures a new contract.

3. Tax Liability

Branches are taxable entities in Qatar. They must register with the General Tax Authority (GTA) and pay 10 percent corporate tax on Qatar-based profits.

4. Full Parent Liability

Because a branch is not a separate legal entity, the parent company bears full responsibility for all debts, claims, and obligations arising in Qatar.

5. Limited Scope for Diversification

The branch can only perform activities directly related to its approved contract. Any additional services or commercial expansion require a new approval from MOCI.

6. Closure Requirements

When the project concludes, the branch must submit final audited accounts and obtain clearance from all authorities before license cancellation.

WRITTEN BY

Unais Naranath

Manager at Meem Business Services

Unais is a specialist in government relations with a background shaped by key roles in Qatar’s medical and public sectors. His experience includes 2 years with Naseem Al Rabeeh Medical Center (MOPH), and 1 year as a Qatar Public Relations Officer.

Connect on LinkedIn →